Yes. UniPayment operates under a global compliance framework. We are a registered Money Services Business (MSB) with FINTRAC in Canada and act as an Authorized EMI-Agent in the EEA, ensuring strict adherence to international financial standards.

Boost Global

Sales with

Hybrid Payments

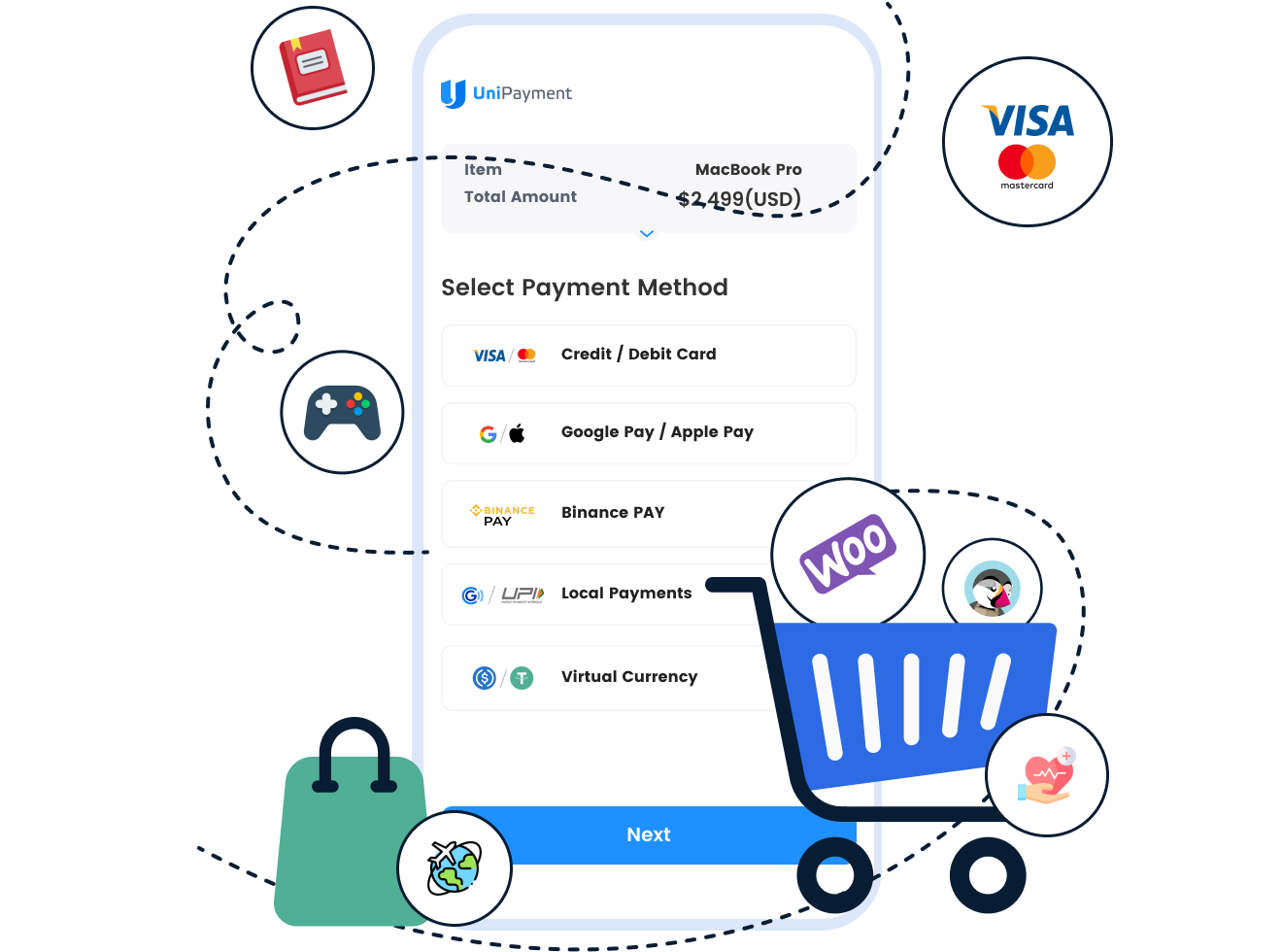

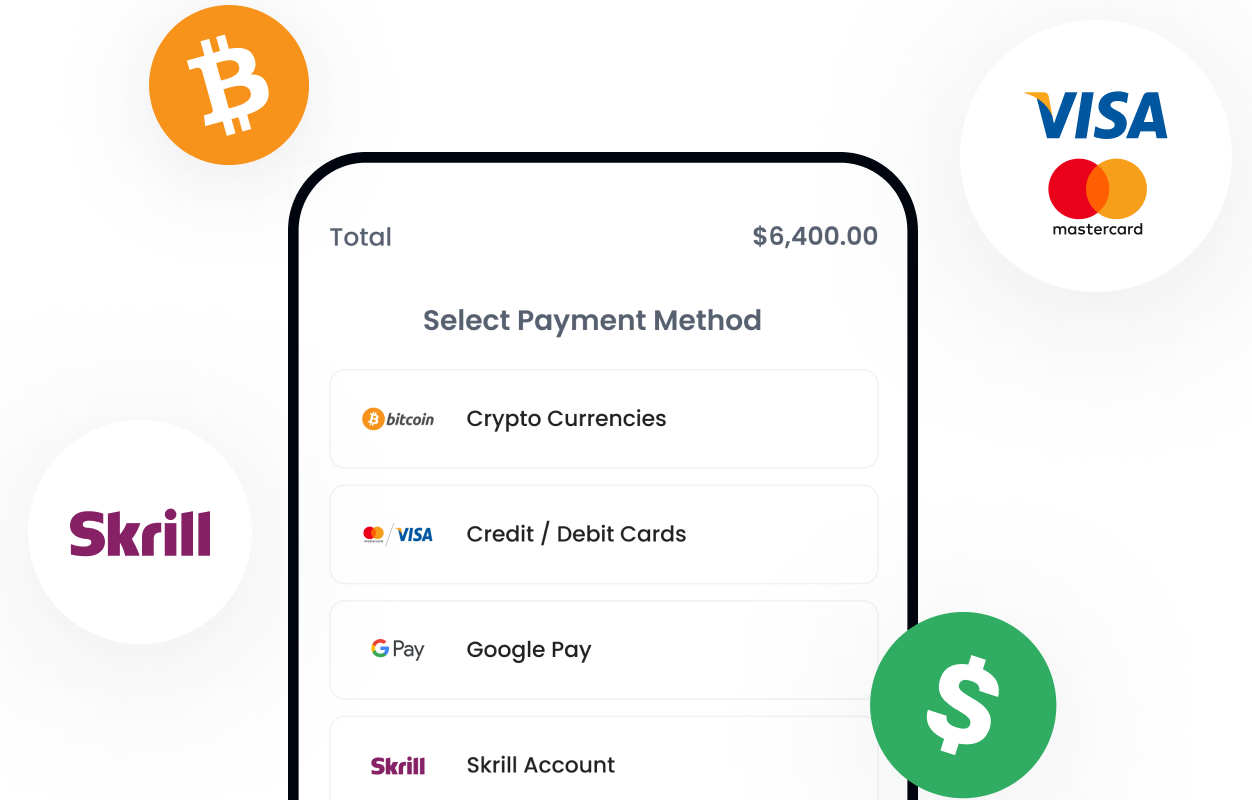

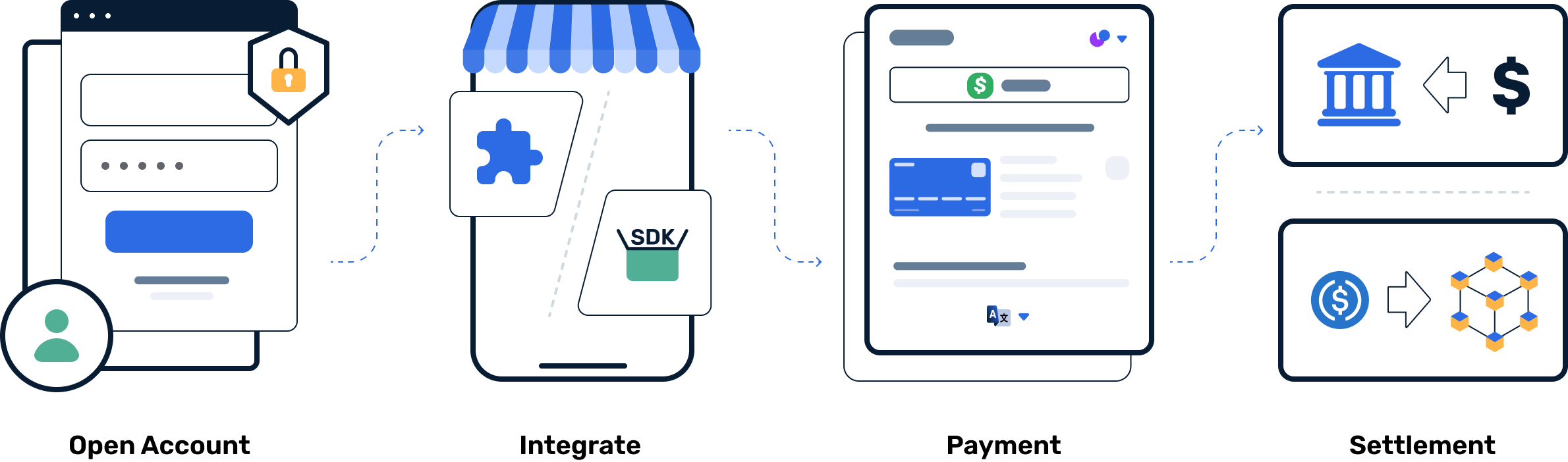

Accept cards, APMs, and digital currencies via one integration. Settle globally.

Accept global payments via international cards and local payment methods.

Combine cards, APMs, and digital currencies to reduce cart abandonment.

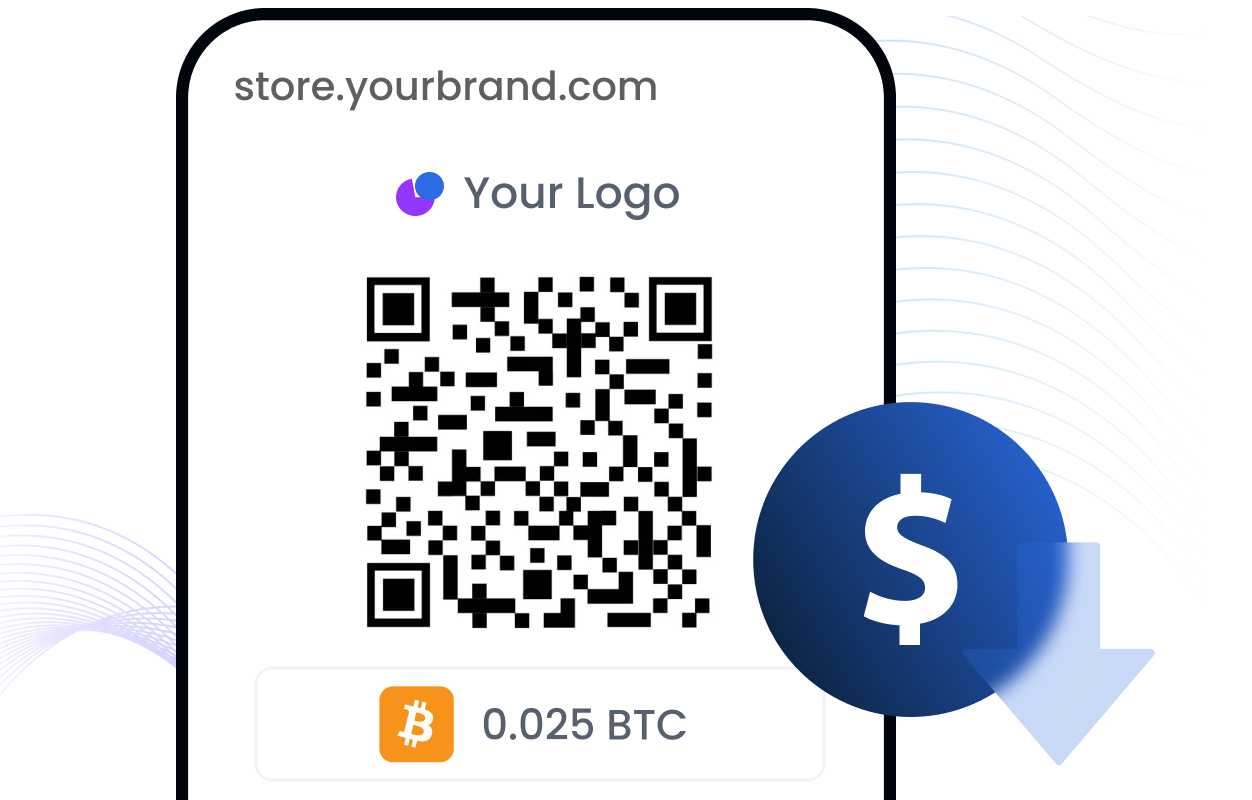

Fully customizable checkout pages to match your store's brand identity.

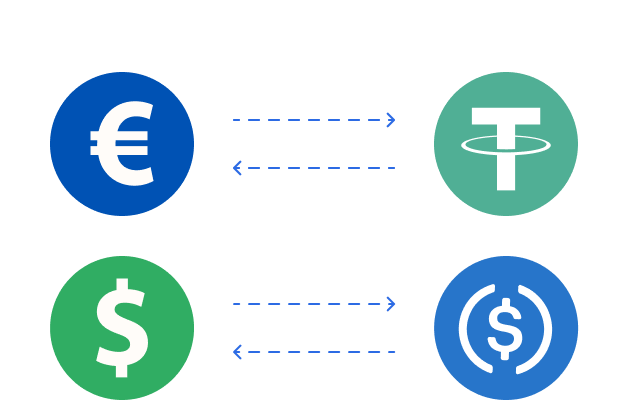

Auto-convert incoming digital currencies to fiat to protect your margins.

Manage refunds and resolve disputes efficiently from a single dashboard.

Settle in Fiat or Stablecoins with transparent financial reporting.

Outperform traditional providers with instant settlements, zero-volatility conversion, and named business accounts.

Connect UniPayment to your existing store via robust APIs or pre-built plugins.

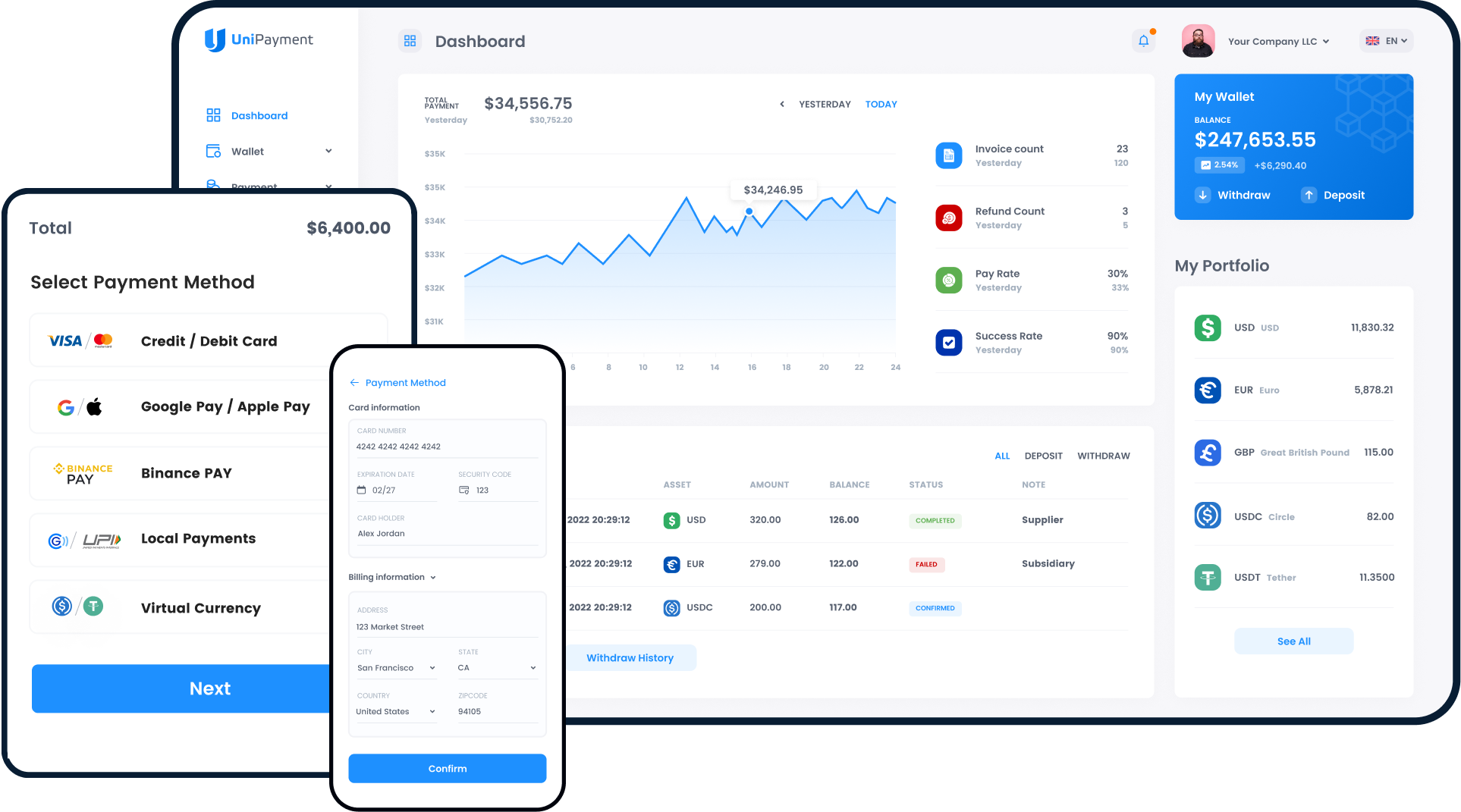

Manage transactions, invoices, and customers with a fully customizable dashboard and real-time insights.

Customize your payment page to match your store’s identity and build buyer trust.

Track sales, manage refunds, and monitor settlements instantly from one view.

Yes. UniPayment operates under a global compliance framework. We are a registered Money Services Business (MSB) with FINTRAC in Canada and act as an Authorized EMI-Agent in the EEA, ensuring strict adherence to international financial standards.

Yes. We adhere to PCI-DSS standards and utilize advanced encryption protocols. For card transactions, we employ 3D Secure technology to prevent fraud and ensure data safety.

Yes. Digital assets are secured using enterprise-grade MPC wallet technology (via Safeheron). Fiat funds are safeguarded in segregated accounts with Tier-1 banking partners, fully separate from company funds.

UniPayment provides real-time rates based on competitive market data. Our pricing is transparent, with clear breakdowns of conversion rates and fees before you confirm any transaction.

We offer competitive pricing tailored to your business model and volume. Contact our sales team for a detailed fee structure customized for your needs.