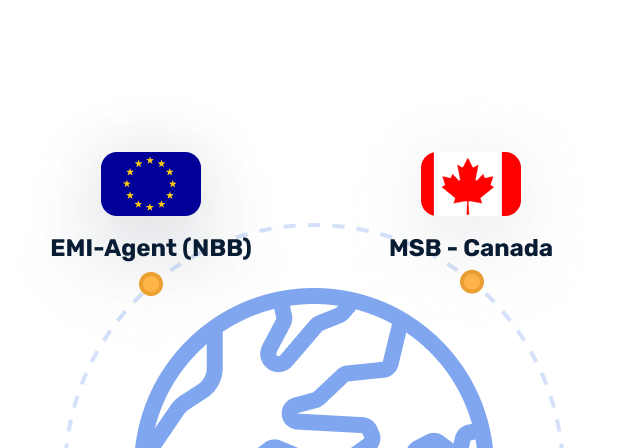

Yes. UniPayment operates under a strict global regulatory framework. We are a registered Money Services Business (MSB) with FINTRAC (Canada) and serve as an Authorized EMI-Agent in the EEA, ensuring full compliance for brokerage payments.

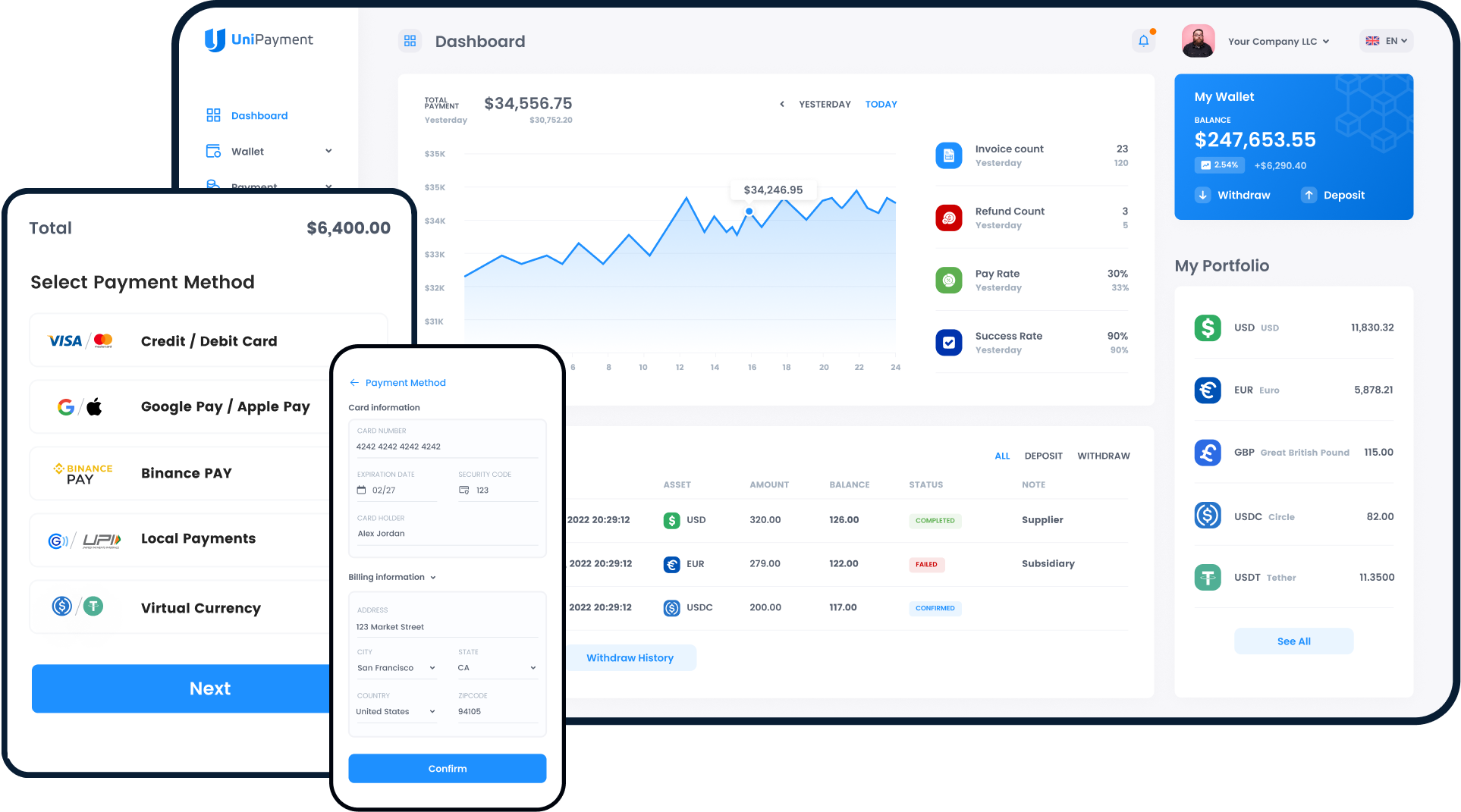

Unified Payment Infrastructure for FX & CFD Brokers

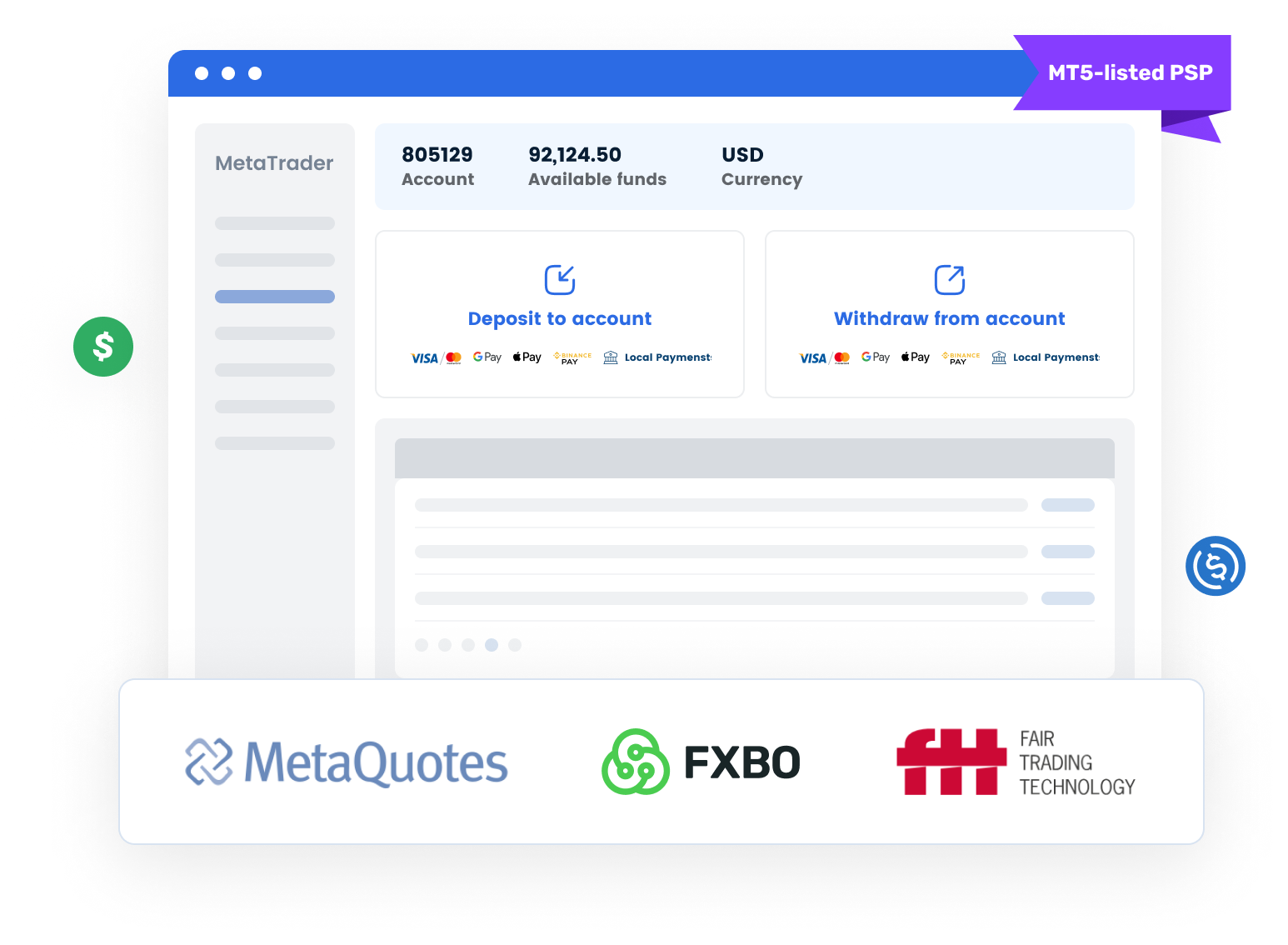

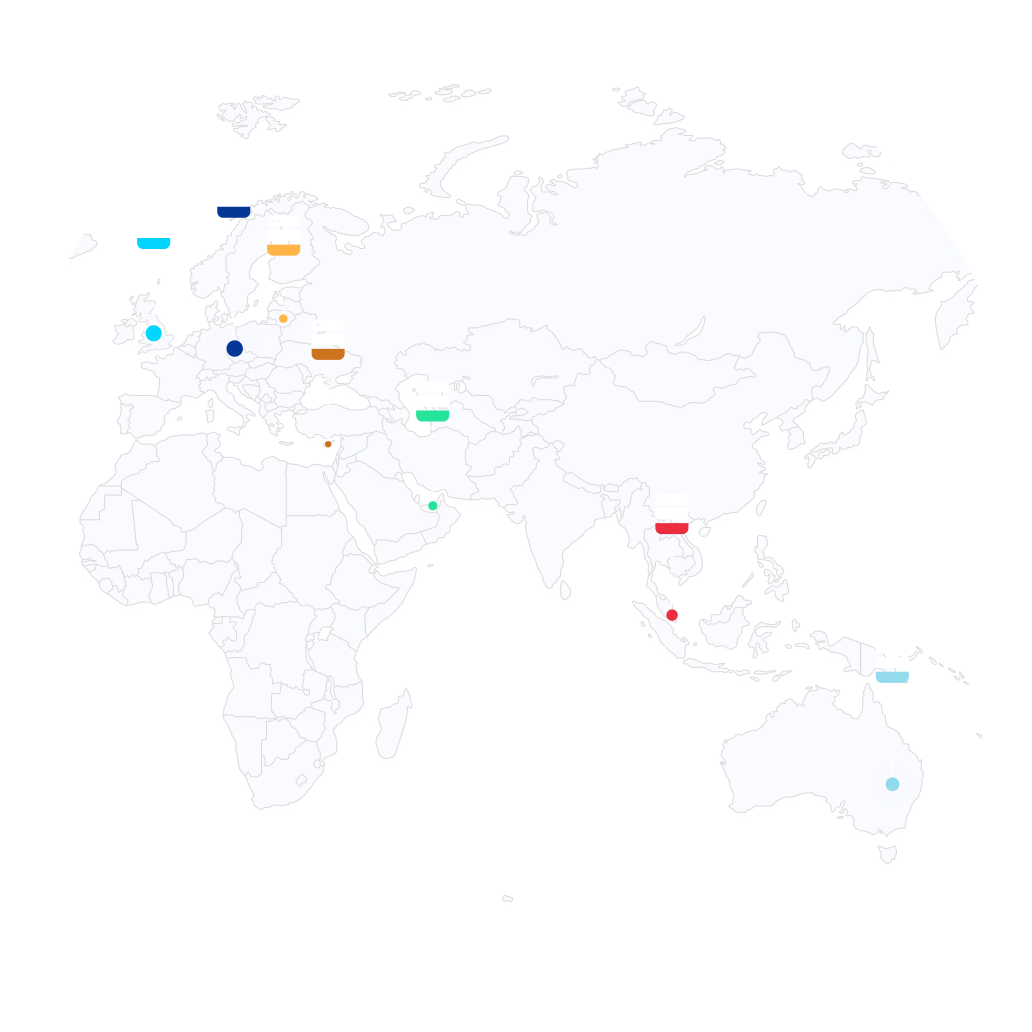

Cards, Local Rails & Stablecoins — One Gateway. MT5-Integrated, Smart Routing.

Operates under FINTRAC (Canada) and NBB (EEA) frameworks.

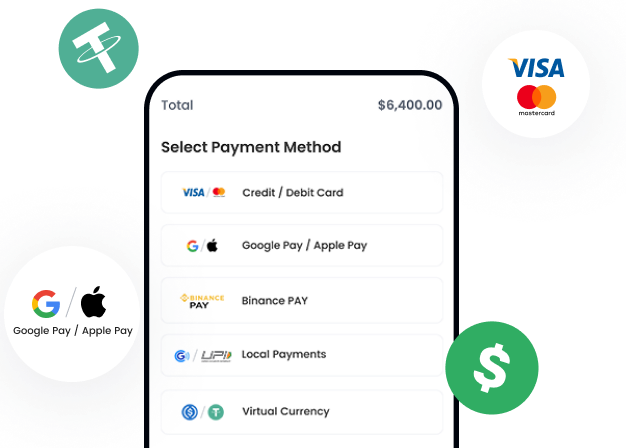

Accept deposits via Fiat and Stablecoins to maximize funding options

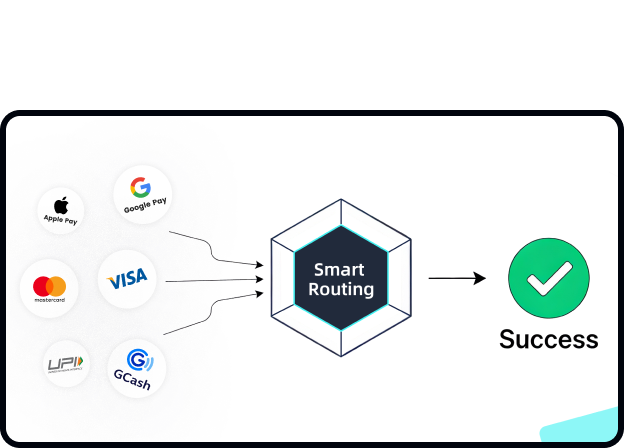

Maximize approval rates via smart routing across global payment channels.

Simplify finance operations with real-time matching of deposits and settlements.

Streamline trader and affiliate payouts from a unified dashboard.

Access detailed transaction logs and comprehensive financial reporting.

Pre-integrated with leading Forex CRMs (FXBO, B2Core) for rapid deployment.

Fully customizable payment interface that matches your broker brand identity.

Direct connection to your existing CRM via robust APIs.

Outperform competitors with higher approval rates, instant stablecoin settlements, and seamless CRM integration.

Built for stability, our infrastructure ensures 99.99% uptime and seamless processing for deposits and withdrawals. Supported by Tier-1 data centers and global compliance standards to maintain uninterrupted brokerage operations.

Yes. UniPayment operates under a strict global regulatory framework. We are a registered Money Services Business (MSB) with FINTRAC (Canada) and serve as an Authorized EMI-Agent in the EEA, ensuring full compliance for brokerage payments.

We offer volume-based competitive pricing tailored for Forex brokers. Our fee structure is transparent, with no hidden charges. Contact our sales team for a custom quote based on your monthly processing volume.

We support a hybrid mix of payment methods: Major Cards (Visa/Mastercard), Local Rails (such as SEPA), and Digital Currencies(USDT/USDC).

Digital currency transactions are settled instantly. Fiat settlements via SEPA Instant are real-time, while SWIFT transfers typically follow standard banking cycles (T+1 to T+3).

Integration is seamless with our pre-integrated support for MT5, FXBO, and B2Core. For custom platforms, our robust API and detailed documentation ensure a smooth setup.