How Stablecoin Payments are Transforming Forex Transactions

Insights

The global forex market is immense, with daily transaction volumes reaching approximately $7.5 trillion according to the latest data from the Bank for International Settlements (BIS). Despite this scale, many businesses continue to face persistent challenges in cross-border payments, which not only increase operational costs but also weaken their competitiveness in the global market.

What are the Real Barriers in Forex Payments?

Several critical issues persistently affect forex transactions:

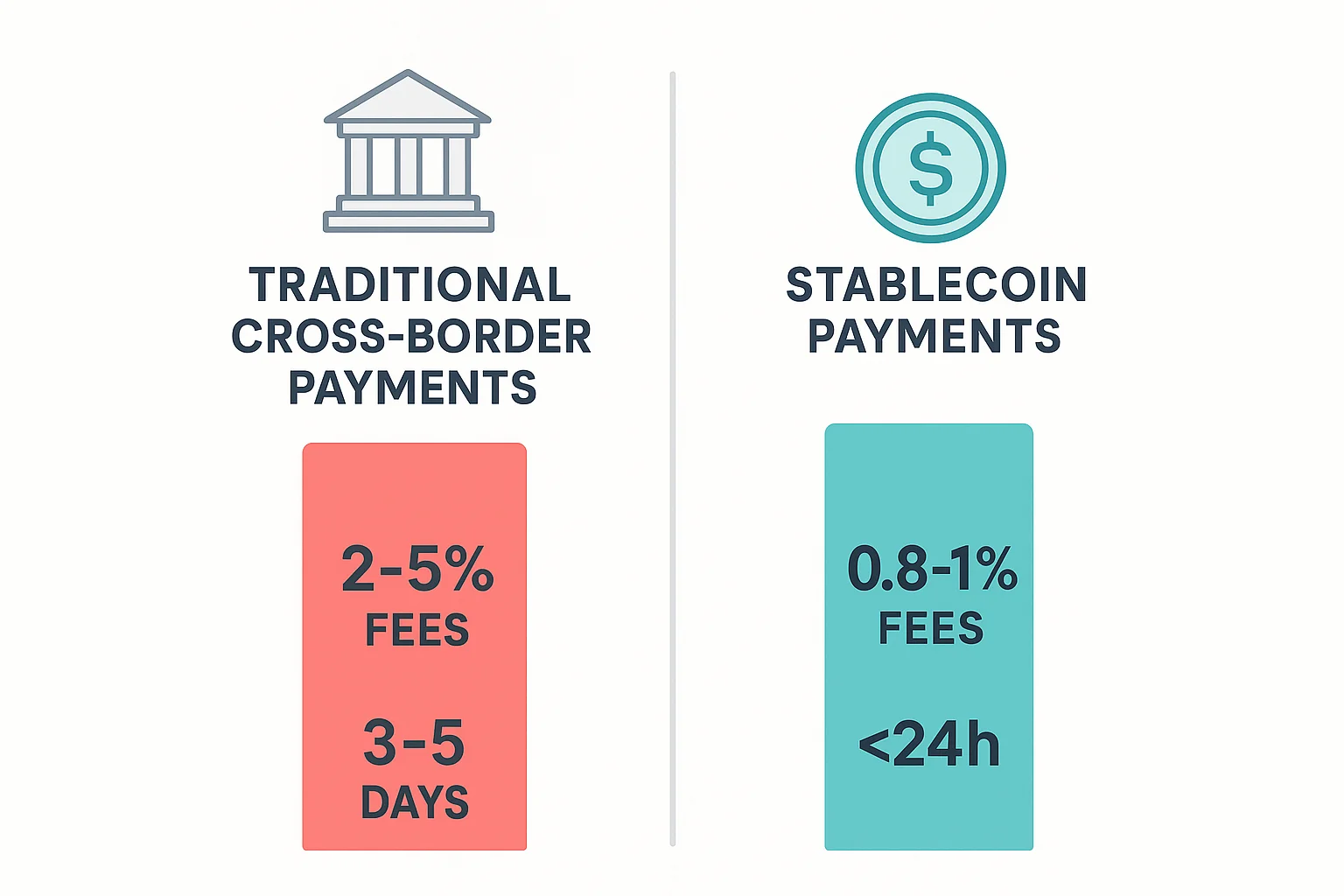

- High Payment Costs: Cross-border bank transfers often incur cumulative fees (including handling charges and foreign exchange losses) amounting to 2%-5% of the transaction value, primarily due to the complex structure of banking networks and intermediary institutions.

- Lengthy Settlement Periods: Traditional bank transfers typically take several days to settle due to extensive regulatory scrutiny and complex global banking reconciliation processes.

- Strict Regulatory Compliance: Increasingly stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations require businesses to allocate significant resources, escalating payment complexity and operational costs.

These persistent challenges with traditional payment channels have motivated businesses to seek alternative solutions, such as stablecoin payments.

Can Stablecoin Payments Effectively Address These Issues?

Stablecoins have increasingly demonstrated significant advantages in forex payment contexts:

- Cost Efficiency: Stablecoin payments utilize decentralized blockchain technology to eliminate numerous intermediary banking layers, significantly reducing payment costs. According to the Circle 2025 USDC Economic Report, businesses have reported average cost reductions of approximately 40%.

- Speed Advantage: Blockchain technology allows almost instantaneous transaction settlements, removing delays associated with traditional cross-border reconciliation and regulatory checks. Circle's report also indicates businesses typically complete settlements within 24 hours using stablecoins.

- Regulatory Compliance: While stablecoins are subject to stringent regulation, their transparent and traceable transaction records facilitate effective monitoring of AML and KYC compliance.

The regulatory frameworks of major economies are increasingly clear, laying the groundwork for broader adoption of stablecoin payments. Examples include:

- United States: U.S. regulatory bodies have established foundational regulatory frameworks for stablecoins as payment instruments, with proposals like the Stablecoin Transparency Act actively progressing.

- European Union: The EU's Markets in Crypto-Assets (MiCA) regulation clearly outlines regulatory pathways for stablecoins, reinforcing standards for issuance and payment applications.

- Singapore: The Monetary Authority of Singapore (MAS) has expressed clear support for commercial stablecoin applications under compliance conditions and issued corresponding regulatory guidelines.

Nevertheless, businesses must carefully evaluate and manage potential risks when implementing stablecoin payments.

How to Effectively Implement Stablecoin Payments?

Here are practical steps businesses can take in the short term to successfully implement stablecoin payments:

- Stay Updated on Regulatory Changes: Continuously monitor regulatory developments across relevant regions to ensure payment processes remain compliant.

- Conduct Small-Scale Pilot Projects: Validate the feasibility and market acceptance of stablecoin payments through controlled pilot projects, gradually expanding their use.

- Partner with Reliable Payment Service Providers (PSP): Ensure that PSPs have robust compliance capabilities, technical security, and extensive cross-border payment experience.

- Adopt Multi-Currency Wallets: Provide flexible currency management solutions to mitigate foreign exchange risk and meet diverse international transaction requirements.

- Optimize Payment Gateways: Deploy efficient and reliable payment gateways to facilitate rapid transaction processing and real-time settlements.

These recommendations can assist businesses in effectively adopting stablecoin payment solutions in the short term. However, maintaining long-term competitive advantages requires comprehensive strategic planning.

Long-Term Strategic Trends in Stablecoin Payments

Although this article primarily discusses forex transactions, the potential applications of stablecoin payments extend far beyond this domain. To sustain competitive advantages in the long term, businesses should focus on broader payment trends:

- Mainstream Adoption of Stablecoin Payments: With clearer global regulatory frameworks, stablecoin payments are likely to become widely accepted and potentially mainstream.

- Integration of Multi-Channel Payments: Businesses should proactively integrate multiple payment channels, creating flexible and secure payment ecosystems adaptable to diverse global market needs.

- Widespread Use of Compliance Technology (RegTech): Regulatory technology will become critical to achieving long-term strategic goals, effectively meeting regulatory requirements, controlling risks, and improving payment efficiency.

At UniPayment, we have helped numerous businesses successfully implement stablecoin payment solutions. Our payment gateway supports leading stablecoins such as USDT and USDC, enabling instant settlements and currency conversions, comprehensive compliance support, and integrated multi-channel payment services that significantly reduce costs and improve liquidity. If you're considering stablecoin payments, contact us to explore the various potential use cases.