In modern finance teams, collaboration never happens in silos—especially when money is on the line. As analysts, compliance officers, and external developers join the workflow, the question shifts from how to move funds to who is authorised to do so. New regulations and a steady rise in credential-driven attacks make granular access control and secondary verification the new baseline for any business that processes payments at scale.

When several employees share credentials to a payment system, it is impossible to trace individual actions, enforce separation-of-duties, or pass an audit. A single mis-click can expose settlement records or trigger an unauthorised refund, and regulators treat shared accounts as a control failure. In 2025, spreadsheets of passwords simply do not meet modern governance expectations.

Multi-User Access & Role-Based Permissions — create precise roles such as Manager, Finance, Compliance, Tech, Viewer so every user sees only what the job requires.

Dynamic OTP Verification — sensitive operations (e.g., payouts, key-rotation, refunds) trigger a one-time-password (OTP) challenge, while any unauthorized operation is blocked.

Real-time audit logs — every change is time-stamped and retained for reviewers and assessors.

Granular control

• Operational effect — Each role contains only the privileges required.

• Practical upside — Prevents accidental refunds & data leaks.

Risk‑based OTP

• Operational effect — O OTP appears only when risk warrants it.

• Practical upside — Internal telemetry shows a 70% drop in unauthorised-action attempts.

Audit‑ready logs

• Operational effect — Least-privilege plus immutable records align with PCI DSS and GDPR.

• Practical upside — Faster due-diligence cycles and smoother audits.

Restricting who can do what—and gating high-risk actions with OTP—directly addresses these insider- and credential-based threat vectors, which UniPayment 1.6 is designed to solve.

Use your sandbox environment first; roles and OTP behave exactly as in production.

No. Existing API keys are not affected.

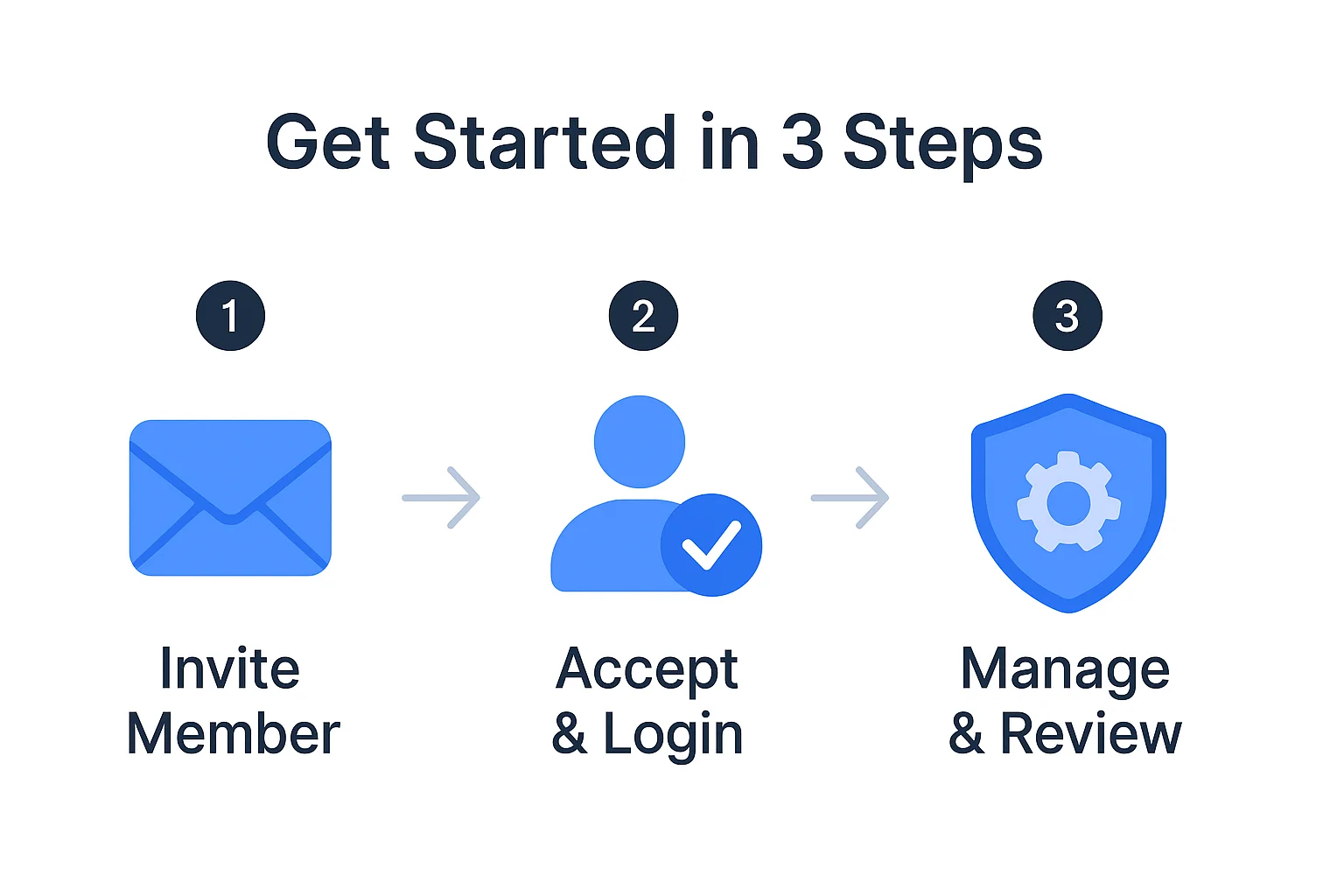

Both controls are live for every UniPayment account today. For step-by-step guidance or a visual walkthrough, see our detailed configuration guide, or request a short demo with our support team.